There seems to be a growing and somewhat perplexing trend of individuals embracing the idea of “unretiring”—coming out of retirement and returning to work.

While traditional retirement was once perceived as the ultimate goal and symbol of success, many people are now redefining what it means to be retired.

Unretiring is a relatively new term that refers to the act of returning to work or pursuing new career opportunities after retiring. Retirement was typically seen as the end of one’s working life, with relaxation and leisure taking center stage.

However, this traditional notion has been challenged in recent years, with more individuals opting for unretirement.

The rise in unretiring can be attributed to various factors such as increased life expectancy, financial concerns, and a desire for personal fulfillment. In many cases, the reality of life after retirement didn’t quite meet expectations.

The urge (or need) to return to the workforce is being considered by 1 in 6 retirees today, according to a recent survey by Paychex.

One significant factor driving the unretiring phenomenon is longer life expectancy. With advancements in healthcare and better overall wellness, individuals are living longer and healthier lives.

Retirement no longer means 20 or 30 years spent solely on leisure activities; it has become just one chapter among many in a multi-act life script. As people realize they have more time ahead of them after retiring at 60 or 65, they often feel compelled to continue pursuing their passions or engaging in meaningful work.

Financial considerations also play a crucial role in this shift towards unretiring. The reality is that not everyone has sufficient savings to support an extended retirement period comfortably. Rising costs of living, medical expenses, and inflation can quickly deplete nest eggs intended for years without employment income.

Financial considerations also play a crucial role in this shift towards unretiring. The reality is that not everyone has sufficient savings to support an extended retirement period comfortably. Rising costs of living, medical expenses, and inflation can quickly deplete nest eggs intended for years without employment income.

To secure their financial future or maintain their quality of life, retirees may need to find alternative sources of income by resuming work either full-time or part-time.

But it’s not just about money – many people also unretire out of a desire for personal fulfillment or a sense of purpose. After spending decades building careers and contributing to society, some retirees find it difficult to adjust to a life without work entirely.

They crave intellectual stimulation, social interaction, and the gratification that comes with making a difference in the world. Unretiring allows them to tap into these desires once again while maintaining an active lifestyle.

Overall, unretiring poses an interesting shift in our cultural norms around retirement. It challenges us to reconsider what it means to age gracefully and embrace later stages of life with vitality rather than slowing down permanently.

3 Key Reasons Why People Choose to Unretire

So, here are more details about the top 3 reasons retirees are choosing to unretire and re-enter the workforce.

- Boredom.

One of the main reasons why people choose to unretire is simply because they miss having a sense of purpose and meaning in their lives. Retirement may initially seem relaxing and carefree, but after a while, many individuals find themselves longing for something more.They become bored, and even disenchanted with their lives once they no longer have a job. They realize that work provided them with structure, social interaction, and a sense of accomplishment that can be difficult to replicate outside of the workforce.

This doesn’t mean that they return to the job they once had, however. Often, individuals who unretire return to a job with more flexibility, less hours, and little to no stress.

- Financial Insecurity.

Another factor driving the trend of unretirement is financial necessity. In today’s economy, retirement savings may not always be sufficient to sustain one’s desired lifestyle.Rising healthcare costs, unexpected expenses, or simply wanting to maintain a certain standard of living may lead retirees back into the workforce. With people living longer than ever before and often having active lifestyles well into their later years, it makes sense that many want or need to continue earning an income.

Some retirees find that their savings may not be enough to support them throughout their golden years due to losses in the stock market and other conditions and an ever-increasing cost of living. In some cases, retirees didn’t really save money for retirement at all, incorrectly thinking that their Social Security benefits would be enough.

Or, they realize the things they really want to do in retirement (such as travel) are going to drain the money put back for the retirement years, and don’t want to forgo their plans. By going back to work, they can supplement their income and ensure a more comfortable retirement.

- New Passions.

Some individuals choose to unretire because they discover new opportunities or passions that they hadn’t explored before retiring. Whether it’s starting a new business venture, pursuing a creative endeavor like writing or painting, or even going back to school for further education, these individuals find inspiration and fulfillment in embarking on fresh ventures later in life.Unretirement offers them the chance to reinvent themselves and follow their dreams without the same financial pressures or career expectations as when they were younger.

There are numerous inspirational stories about individuals over age 60 entering the classroom for the first time, designing clothes, opening an art gallery, or even starting a blog.

Challenges of Unretiring

However, unretiring also comes with its fair share of challenges. The job market is highly competitive, especially for older individuals who may face ageism in the form of discrimination and bias, or find their skills are outdated compared to younger counterparts.

However, unretiring also comes with its fair share of challenges. The job market is highly competitive, especially for older individuals who may face ageism in the form of discrimination and bias, or find their skills are outdated compared to younger counterparts.

Additionally, stepping back into a work routine after a period of absence can prove difficult in terms of adjusting mindset and managing new responsibilities. It requires adaptability and resilience to overcome these obstacles and successfully reintegrate into the workforce.

Retirees who want to rejoin the workforce also want to do so on their terms. According to the Paychex survey, 53 percent of the 1 in 6 retirees considering working again want remote positions. Of those surveyed, those thinking about returning to a job were out of the workforce for an average of four years.

Additionally, 74 percent of those who have returned feel judged by co-workers because of their age. And, sadly, ageism is apparent in that 62 percent of hiring managers are skeptical about hiring retirees.

Overall, however, the trend of unretiring signifies a shift in society’s perception about retirement as being solely focused on leisure. It highlights the desire for personal fulfillment and continued personal growth even during later stages of life.

Examples of Successful Unretirees

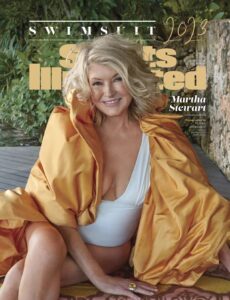

Unretiring, the act of coming out of retirement and rejoining the workforce, is a growing trend that reflects a shift in our views on age and productivity. One shining example of a successful unretiree is Martha Stewart.

After spending time in prison, Stewart returned to her brand with renewed vigor, expanding it to include new ventures such as television shows and cooking products. Not only did she regain her standing in the business world, but she also became an inspiration for others who felt their best days were behind them.

In 2023, she not only turned heads, but opinions as well, when at age 81, appeared on the cover of Sports Illustrated for its Swimsuit 2023 edition.

Another celebrity success story is David Letterman. After retiring from his late-night talk show in 2015, many thought he would quietly enjoy his remaining years. However, his recent Netflix series demonstrates that retirement doesn’t have to mean the end of one’s creative contributions. By embarking on a new project outside traditional broadcast networks, Letterman has shown that there are endless opportunities for reinvention later in life.

These examples show us that unretiring can be a path towards personal fulfillment and professional accomplishment. Rather than seeing retirement as an endpoint or a withdrawal from society, these individuals have embraced it as an opportunity for growth and reinvention. Their experiences challenge societal norms surrounding aging and remind us all that age should never limit our aspirations or potential for success.

Possible Financial Impact of Social Security Benefits of Unretiring

Before you once again say “you do” to work, there are some potential financial consequences you should consider first. The first is whether returning to work would affect your Social Security benefits? The answer is simply, it depends. The key factors are how old you are and what your current benefits are.

Age, not surprisingly, is the biggest factor in determining how Social Security benefits could be affected. The earliest a person can begin receiving Social Security retirement benefits is age 62, but that is not considered “full retirement age.”

According to the Social Security Administration (SSA), full retirement age is 66 if you were born between 1943 and 1954. For those born from 1955 to 1959, two months are added for every birth year under a staggered increase until the full retirement age reaches 67. If you were born in 1960 or later, age 67 is full retirement age.

If that sounds confusing (and does to me), you can view the SSA’s chart of birth year/retirement. It also includes important information about when to apply for Medicare benefits.

In terms of unretiring, if you are under age 70 and decide to leave retirement and return to work within 12 months of applying for your Social Security benefits, you can withdraw your application. You’ll also need to pay back any benefits you’ve already received. You’ll be fully eligible to reapply later.

However, if you’re at full retirement age but choose to return to work, your benefits won’t be affected.

There’s also a special earnings limit rule on how much you can earn and still receive your full retirement benefits while working. Some individuals who file for benefits mid-year have already earned more than their annual earnings limit amount, and this rule comes into play for those circumstances.

Finally, the SSA has an earnings test to help you determine if benefits will be withheld if you return to the workforce if you’re under your normal retirement age.

Other Considerations to Make Before Making the Leap Back to Work

Other considerations should include how going back to work could potentially affect Medicare coverage, your taxes, and pension.

While unretiring and returning to work is an option being taken by a growing number of retirees today, it isn’t advantageous for everyone. Be sure to consult with a financial advisor or a retirement expert before making a decision, if possible. And if you are still working, make sure you truly are ready to retire before announcing your departure. And if you have already retired, make sure that the benefits of unretiring (such as you need the income) work in your favor financially overall.

And, remember, if money isn’t the financial motivator to unretiring, you can always opt to volunteer your services instead.

Here are more articles worth a read about retirement and what you might find in the workplace today if you unretire:

- Older Workers: The Value of Age Diversity in the Workplace

- Ageism Examples: 1 in 2 People Are Ageist Against Seniors

- 8 Critical Questions to Ask Before Collecting Social Security Income

- When to Retire – 5 Reasons Why Timing is Everything!

- 9 Powerful Reasons Why You Can and Should Retire Today

- Maximizing Income and Security: 9 Reasons to Delay Retirement

Contact Us

Written by

Robin McClure

Robin is the author of 7 parenting books and has 3 grown children, 3 spoiled rescue dogs, and a very understanding husband. She holds a bachelor's degree in journalism and a master's degree in communications, and spends her time writing, drinking coffee, and planning the next grand adventure.